Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.

What's New

Upcoming Events

CNYBJ Job Board

F.X. Matt Brewing Co. names Nick R. Matt Saranac brand manager

UTICA — Nick R. Matt has joined F.X. Matt Brewing Company as Saranac brand manager. He is the son of Chairman and CEO Nicholas O.

Rheonix names vice president of manufacturing

ITHACA — Rheonix, Inc., an Ithaca–based microfluidics company, today announced the addition of Frank Gill as vice president of manufacturing. Gill will be responsible

May jobs report shows mixed economic picture

U.S. employers added 175,000 jobs to their payrolls in May, the U.S. Bureau of Labor Statistics (BLS) reported Friday. That beat economists’ average estimates

SBA to solicit for SBIC early-stage fund this fall, expanding investment leverage

U.S. Small Business Administration (SBA) administrator Karen Mills has announced the agency’s next solicitation for its Small Business Investment Company (SBIC) early-stage fund will open

KIRKWOOD — And the winner of “Do Us a Flavor” is — Karen Weber-Mendham of Land O’ Lakes, Wis. The date: May 6. The location: Eva Longoria’s upscale Beso Restaurant in Hollywood. Representatives of Frito-Lay announce that Weber-Mendham is the recipient of either $1 million or 1 percent of the 2013 net sales of her

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

KIRKWOOD — And the winner of “Do Us a Flavor” is — Karen Weber-Mendham of Land O’ Lakes, Wis. The date: May 6. The location: Eva Longoria’s upscale Beso Restaurant in Hollywood.

KIRKWOOD — And the winner of “Do Us a Flavor” is — Karen Weber-Mendham of Land O’ Lakes, Wis. The date: May 6. The location: Eva Longoria’s upscale Beso Restaurant in Hollywood.

Representatives of Frito-Lay announce that Weber-Mendham is the recipient of either $1 million or 1 percent of the 2013 net sales of her award-winning suggestion for “Cheesy Garlic Bread,” whichever is larger. The other two finalists, who submitted “Chicken and Waffles” and “Sriracha” (a hot sauce from Eastern Thailand), each receives $50,000.

Frito-Lay garnered nearly 4 million submissions through social media from American consumers for the contest. A panel of judges picked the three finalists whose recipes were developed by the company and the new products were placed on store shelves last February. Earlier this year, more than 1 million consumers cast ballots by texting or via Twitter or Facebook to determine the winner.

“This is one way the world’s number-one snack and food brand is listening to its customers,” says Mitchell T. Hamilton, director of manufacturing at Frito-Lay North America’s plant located at 10 Spud Lane in Kirkwood, just a few miles from downtown Binghamton. Listening to its customers yielded Frito-Lay $13.574 billion in revenue last year and an operating profit before-taxes of $3.646 billion (26.9 percent profit margin). Of the 48,000 employees companywide, the “Kirkwood plant employs 530 — 330 in manufacturing, 100 in traffic, and 100 in the warehouse,” notes Hamilton.

“The plant opened in November 1974 with 130,000 square feet and about 120 employees. In 1978, we added a warehouse with 65,000 feet and another 46,000 feet in the 1990s,” continues Hamilton. “The plant now [covers] close to 250,000 square feet and is [sited] on 43 acres (The company owns the site and building.) … [Our facility] has eight production lines going three shifts a day, seven days a week, and produces more than 100 million pounds of finished product annually, which includes Lay’s Potato Chips (regular, salt and vinegar, BBQ, sour cream and onion, cheddar), Ruffles, Lay’s Wavy, Fritos, Doritos, Tostitos, and Santitas.

“Kirkwood is a highly automated operation,” says Hamilton. “Frito-Lay takes in 2 million pounds of potatoes every week … We unload the trailers at one end of the plant, wash and peel them; slice them according to the product; and fry, flavor, and package them for storage and shipment at the other end … Sourcing relies on just-in-time inventory deliveries … The plant also processes about 52 million pounds of corn annually … We have 30 maintenance people on staff to ensure our production schedules and 35 tractors and 200 trailers for delivery to our customers, which are located primarily in Upstate and in New England.” Kirkwood inventories 228 different stock-keeping units.

“We buy potatoes from all over the country, although 50 percent of our supply comes from [the province of] Ontario,” adds Hamilton. From the time the crop arrives, we turn it into potato chips within a day and a half. Our corn supply comes by rail from Sydney, Ill., and our corn oil comes in by truck … The purchasing is done from [corporate headquarters] in Plano, Texas … Binghamton is well-located to serve our customers, who are mostly distributors and a few, large, retail customers [to whom] we sell direct. The site’s drivers average about 425 miles a day [round-trip].”

Frito-Lay, a division of PepsiCo, Inc., has been focusing its attention since 2007 on the changing global, consumer environment. That was the year Indra K. Nooyi was appointed chairman and CEO of PepsiCo. Her letter in the 2012 PepsiCo corporate annual report noted continuing consumer shifts. In 2006, emerging markets represented 24 percent of the parent company’s net revenue. At year-end 2012, it was 35 percent. And while consumption is shifting more to Asia, American tastes are also changing, along with a concern for food safety and a heightened environmental consciousness.

“We have eliminated trans-fats from our snack chip, as well as reduced the amount of sodium in many products,” says Hamilton. “We also offer baked products as an option to frying … and introduced multi-grains and whole grains.” In addition to the country’s concern for healthful foods, Christopher T. Kuechenmeister, the senior director of public relations for Frito-Lay, notes America’s changing tastes. “Americans now prefer more flavorful

-

Online Display Advertising

$499.00

Add to cart

-

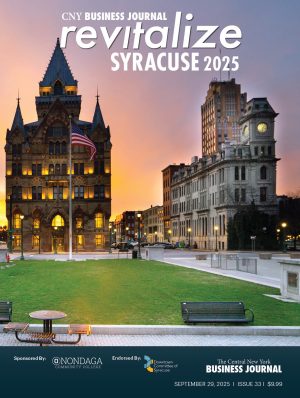

Revitalize Syracuse 2025

$9.99

Add to cart

-

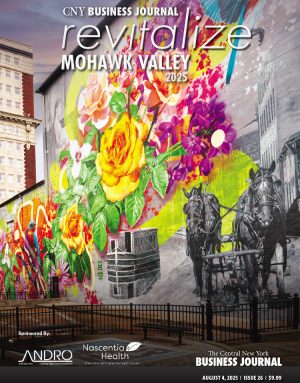

Revitalize Mohawk Valley 2025

$9.99

Add to cart

-

2025 Revitalize Greater Binghamton

$9.99

Add to cart

-

CNY Legends 2024

$9.99

Add to cart

-

Revitalize Syracuse 2024

$9.99

Add to cart

-

Revitalize Mohawk Valley 2024

$9.99

Add to cart

-

2024 Revitalize Greater Binghamton

$9.99

Add to cart

-

2025 Book of Lists

$61.00 – $249.00Price range: $61.00 through $249.00

Select options

This product has multiple variants. The options may be chosen on the product page

-

Article Reprints

$50.00

Select options

-

Central New York Business Journal

From: $79.00 / year

Select options

This product has multiple variants. The options may be chosen on the product page

-

Revitalize Syracuse VII

$9.99

Add to cart

-

Revitalize Mohawk Valley 2023

$9.99

Add to cart

-

Revitalize Greater Binghamton 2023

$9.99

Add to cart

-

Revitalize Syracuse VI

$9.99

Add to cart

-

Revitalize Mohawk Valley 2022

$9.99

Add to cart

-

CNY Legends 2021

$9.99

Add to cart

-

Revitalize Syracuse V

$9.99

Add to cart

-

Revitalize Mohawk Valley 2021

$9.99

Add to cart

-

CNY Legends 2020

$9.99

Add to cart

-

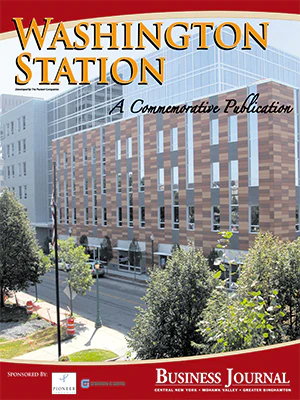

Washington Station Commemorative Publication

$9.99

Add to cart

-

Revitalize Syracuse IV

$9.99

Add to cart

-

Revitalize Syracuse III

$9.99

Add to cart

-

Full Color Plaques

$189.00 – $295.00Price range: $189.00 through $295.00

Select options

This product has multiple variants. The options may be chosen on the product page

-

Revitalize Syracuse II

$9.99

Add to cart

-

NextGen III

$9.99

Add to cart

-

Revitalize Syracuse: The Downtown Transformation

$9.99

Add to cart

-

Hotel Syracuse Commemorative Publication

$9.99

Add to cart

-

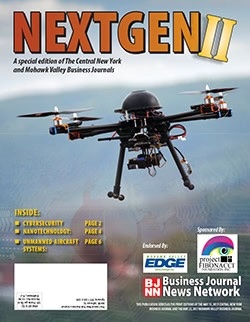

NextGen II

$9.99

Add to cart

-

Mohawk Valley NextGen

$9.99

Add to cart

… [foods that are] more robust. There is a move to more ethnic foods and a more international [cuisine].”

Quality control is a major focus at Kirkwood. “Customers are very sensitive to the taste and freshness of our products,” avers Hamilton. “Analytics don’t tell us everything … We check the raw materials when they are received and each line tastes the product twice each shift while it is being produced. And it’s not just one person; we have a team that rates the product against a benchmark … We offer sensory training on-site and assign three to five members to each tasting team … We also lay a nitrogen barrier into some products to ensure the freshness once the chips are in the package.”

The plant is a model of energy-efficiency and recycling. “Kirkwood buys its electricity off the grid from NYSEG (New York State Electric & Gas). We have multiple ovens running at 350 to 400 degrees (Fahrenheit), and we recover much of that energy to make steam … Of all the waste we produce, less than 1 percent ends up in a landfill … [For example], we collect the starch from our potatoes and bag it for resale. Each truck we fill generates $7,000 [to the company], and the starch is turned into glue for commercial purposes. In the decade from 2000 to 2010, Kirkwood reduced its consumption of BTUs by 31 percent (natural gas), our water consumption declined 63 percent, and electricity usage fell (BTU/lb.) by 29 percent.”

Hamilton is a 28-year veteran at Frito-Lay, with a background evenly split between manufacturing and service/distribution. Born in Kentucky, he started with the company in 1985 and has worked at five different sites. A graduate of the University of North Carolina, Hamilton was an hourly worker at Frito-Lay while earning his degree. In addition to Hamilton, the leadership team at Frito-Lay/Kirkwood includes Jeff Hadwin, senior planning manager; Brian Blackham, human-relations director; Brian Watson, director of logistics, distribution, & traffic; and Tim Polman, director of technology.

PepsiCo, headquartered in Purchase, is the largest food-and-beverage business in the U.S. and the second largest in the world with 2012 annual revenue of $65.5 billion and operating profit before-taxes of $9.1 billion (13.9 percent margin). Net revenues for food and beverage are almost equal. U.S. revenues equal 37 percent of the total and represent 52 percent of companywide profit. Over the last 13 years, PepsiCo shareholder return was $201 on $100 invested; the S&P 500 return was $146.

The company employs more than 300,000 and boasts 19 different product lines that generate more than $1 billion each in annual retail sales. In addition to Frito-Lay, PepsiCo brands include Quaker, Pepsi-Cola, Tropicana, and Gatorade. Its products are distributed in more than 200 countries.

Frito-Lay is the result of a 1961 merger between the Frito Co. and the H. W. Lay Company. In 1965, the new entity merged with Pepsi-Cola to become PepsiCo. Both of the original snack companies were launched in 1932. Frito-Lay brands currently account for 59 percent of the U.S. snack-chip industry.

Contact Poltenson at npoltenson@tgbbj.com

The New York Environmental Facilities Corp. (EFC) board of directors has approved a three-year, $7.3 million loan to the city of Oswego to upgrade equipment

Buffalo Sabres hire Koelmel as president of HARBORcenter

The Buffalo Sabres of the National Hockey League (NHL) on Thursday announced the hiring of John Koelmel as president of HARBORcenter, the mixed-use hockey and

Scolaro law firm and health-care group separate, form new firms

SYRACUSE — The Syracuse law firm Scolaro, Shulman, Cohen, Fetter & Burstein, P.C. and its health-care practice group have separated, and each group of attorneys has formed new law firms. But the separated firms also plan to continue their respective practices in the same building at 507 Plum St. in Franklin Square. The Scolaro firm

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

SYRACUSE — The Syracuse law firm Scolaro, Shulman, Cohen, Fetter & Burstein, P.C. and its health-care practice group have separated, and each group of attorneys has formed new law firms.

But the separated firms also plan to continue their respective practices in the same building at 507 Plum St. in Franklin Square.

The Scolaro firm is changing its name to Scolaro, Fetter, Grizanti, McGough & King, P.C.

The 11 partners in the new Scolaro firm include the five in the firm’s name: Richard Scolaro, who is now retired, Jeffrey Fetter, Anthony Grizanti, Stewart McGough, and John King.

Fetter is serving as the firm’s president and CEO, King is the vice president and CFO, and Grizanti is the COO and secretary, according to Jeffrey Fetter, president and CEO of the new Scolaro firm.

Alan Burstein, who was among the partners in the original Scolaro firm, remains with the new firm as a partner. But he offered to have his name removed from the title of the firm to reflect the beginning of a new generation in the business, according to Fetter. Burstein also remains as chairman of the matrimonial department of the firm.

New York Assemblyman William Magnarelli (D–Syracuse) and Ron Mittleman are also among the 11 partners.

The new Scolaro firm has a total 33 employees, most of whom are full-time employees, says Fetter.

Health-care practice group starts new firm

The Scolaro firm’s former health-care practice group is forming its own law firm with the name Cohen Compagni Beckman Appler & Knoll, PLLC.

The partners in the new firm include Stephen Cohen, Michael Compagni, Marc Beckman, John Appler, and Andrew Knoll.

The new firm has eight lawyers who are leaving the Scolaro firm to form their new “boutique” firm, says Stephen Cohen, one of five partners in the new firm.

“We primarily do health-care work. We have clients from San Diego to Maine, from Florida to Oregon, and most of the places in between,” Cohen says.

The firm employs a total of 13 people, including the eight attorneys, one paralegal, and support-staff members, Cohen adds.

Word of the potential changes at the Scolaro law firm first surfaced in the middle of March.

In an article titled, “Scolaro firm warns staff of possible health-care practice exit” in the March 22, 2013 issue of The Central New York Business Journal, former president and CEO Barry Shulman said the firm had notified the staff on March 18 that the health-care practice might break off to join a downstate law firm.

Cohen, in a June 5 interview, confirmed that the health-care practice group had considered aligning itself with another “large, health-care firm” in the Long Island area.

“We chose not to do that, but instead to form our own firm” Cohen says.

At the same time, Shulman is also leaving the Scolaro firm to joining the Syracuse law firm of Gilberti Stinziano Heintz & Smith, P.C., according to Cohen.

The Scolaro firm also addressed the separation of its former health-care practice group.

“Our former health care department has established its own firm to service their clients’ special needs and we look forward to continuing to work with one another when our clients require services provided by the other,” according to a document the Scolaro firm provided The Business Journal, announcing its new name and structure.

Cohen says that forming a new law firm was a logical move. “We felt that because of the sub-specialty that was involved in our practice … it just made sense to be in a separate practice,” he says.

The attorneys in both firms believe that they can “better serve” their clients in this structure, Fetter says in an interview.

“What they do is so different from what we do … we’re going to continue together on the areas in which neither of us have our own expertise,” Fetter says.

The two firms have an agreement whereby they serve “of counsel” to each other, Fetter adds.

The firms started operating as separate entities at the start of this month and are signing separate leases with The Pioneer Companies for space on the third floor of their Plum Street building, Cohen says.

With the health-care group now practicing on its own, the new Scolaro firm’s practice areas include tax, business, employee benefits, trusts, and estate administration.

Its attorneys advise clients in areas that include the structure and operation or closely held and family businesses, according to the Scolaro firm’s announcement.

Scolaro lawyers also work with business owners in developing estate and business-succession plans, as well as helping clients in acquiring, selling or reorganizing their businesses, the firm said. The firm’s specialty areas also serve clients in matrimonial and family matters and business and estate litigation.

Scolaro, Fetter, Grizanti, McGough & King also has offices in Rochester and Stuart, Fla., according to its announcement.

Contact Reinhardt at ereinhardt@cnybj.com

Golden Artist Colors expands in Chenango County

COLUMBUS, N.Y. — Golden Artist Colors, Inc. has announced the acquisition of the former Apple Converting building in nearby Norwich. The 45,000-square-foot structure will

NFIB critical of federal swimming-pool regulation

The National Federation of Independent Business (NFIB), an organization that advocates for small businesses, is critical of a new federal regulation targeting swimming pools. The U.S. Department of Justice, which administers the Americans with Disabilities Act, issued a new rule requiring businesses with swimming pools and spas to have a lift that can help

Get Instant Access to This Article

Become a Central New York Business Journal subscriber and get immediate access to all of our subscriber-only content and much more.

- Critical Central New York business news and analysis updated daily.

- Immediate access to all subscriber-only content on our website.

- Get a year’s worth of the Print Edition of The Central New York Business Journal.

- Special Feature Publications such as the Book of Lists and Revitalize Greater Binghamton, Mohawk Valley, and Syracuse Magazines

Click here to purchase a paywall bypass link for this article.

The National Federation of Independent Business (NFIB), an organization that advocates for small businesses, is critical of a new federal regulation targeting swimming pools.

The U.S. Department of Justice, which administers the Americans with Disabilities Act, issued a new rule requiring businesses with swimming pools and spas to have a lift that can help wheelchair-bound patrons in and out of the water.

The rule that impacts small businesses such as hotels, motels, bed-and-breakfasts, amusement parks, and recreational facilities, took effect in January, the NFIB said in a news release.

The regulation didn’t specify a type of lift, so “naturally,” many small and family-run businesses began considering a temporary version they could use when needed and move to multiple locations, according to Michael Durant, NFIB New York director.

“But the Department of Justice ruled arbitrarily that every pool must have a fixed lift, bolted permanently to the edge of the water,” Durant explained in the news release. “The fixed lifts cost many thousands of dollars more than the temporary versions, so it’s a big mandatory expense that, like so many other federal regulations, can’t really be justified.”

A temporary lift costs $6,000, compared to a fixed lift, which could cost $10,000 or more, according to the NFIB.

“So imagine [a] small water park or a motel with two pools,” said Durant. “The owner is forced to spend $20,000 for two permanent lifts when one temporary lift would have achieved the same goal.”

If the owner fails to comply, the Justice Department could file a lawsuit, which is “a very scary” possibility that could spell the end of the business, Durant added.

Durant would like to see New York’s congressional delegation push for changes that would give “bureaucrats less discretion to impose rules that can kill honest businesses.”

Contact Reinhardt at ereinhardt@cnybj.com

Get our email updates

Stay up-to-date on the companies, people and issues that impact businesses in Syracuse, Central New York and beyond.